Credit Cards

Grow your spending power with a CCCU Mastercard Credit Card

Members enjoy a low fixed rate with all of our credit card options! Plus, access your account anytime by logging in online.

CCCU Platinum Mastercard

A Platinum Mastercard Credit Card from Cascade Community Credit Union offers a low fixed rate and terms that are hard to beat. With no annual fee, you save money!

- No Annual Fee

- No Cash Advance Fee

- No Balance Transfer Fee

CCCU Rewards Mastercard

With a Rewards Mastercard Credit Card from Cascade Community Credit Union, you still have the savings power from no annual fee, but you also make money by earning cash back! Enjoy the ease of using your Mastercard Rewards anywhere and earn cash back at the same time!

- No Annual Fee

- No Cash Advance Fee

- No Balance Transfer Fee

- 1% Cash Back on all purchases*

- $2,500 min. credit limit

CCCU Share Secured Platinum Mastercard

A Share Secured Platinum Mastercard Credit Card is a great way to establish or reestablish credit while still allowing yourself the convenience of a credit card. After a simple application process and your deposit to secure the card we will issue a card that can be used anywhere Mastercard is accepted.

- Low Interest Rate

- Payments are 3% of the outstanding balance

- No Cash Advance Fee

- No Balance Transfer Fee

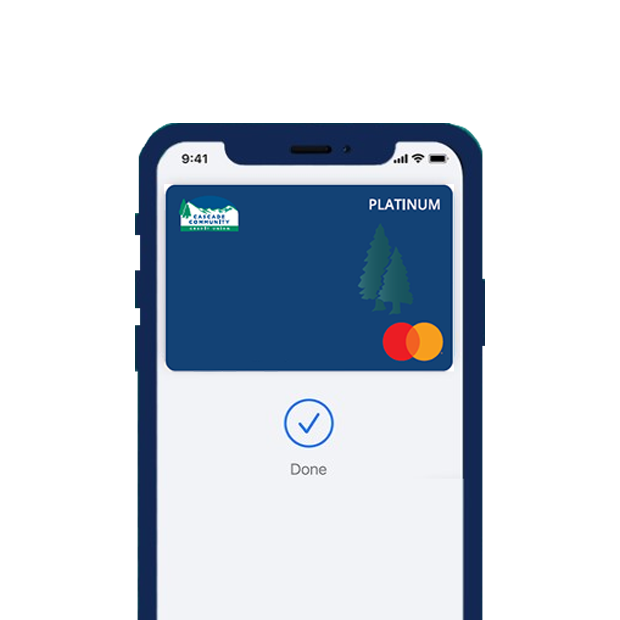

Add Your CCCU Card to your Mobile Wallet

*Excludes balance transfers and cash advances. Auto deposit to savings on the 17th of each month.

Mastercard Disclaimer: Cash Rewards. If you have a Mastercard Rewards Account, you may earn a cash reward equal to 1.00% of net purchases (purchases less returns and other credits) made during a billing cycle. Cash advances, including convenience checks and balance transfers, and any other amounts other than purchases do not qualify for the cash reward. Your account must remain open and in good standing in order to receive the cash reward. If your account is closed before a cash reward is paid, you will forfeit that reward. If your account is past due, over the limit, is otherwise in default, is fraud restricted, is part of a consumer credit counseling arrangement, or is subject to discharge in a pending bankruptcy, you will forfeit all cash rewards accrued and will not be eligible for further rewards until the disqualifying condition is remedied. The terms and conditions of the reward program may be changed or canceled at any time and for any reason without notice.