| One of our top recommendations for members who come to us struggling with debt, is to consolidate their debt. By consolidating your debt from multiple credit cards or lines of credit into a single, lower rate solution, it will allow you to pay less over the life of your debt, pay your debt off sooner and get some financial breathing room!

Breaking Down Debt Consolidation

Debt consolidation rolls multiple debts into a single payment via a personal loan, line of credit or credit card. As we covered above, it will save you time and money.

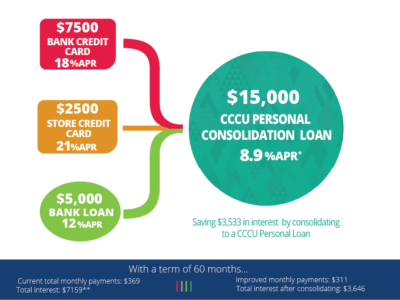

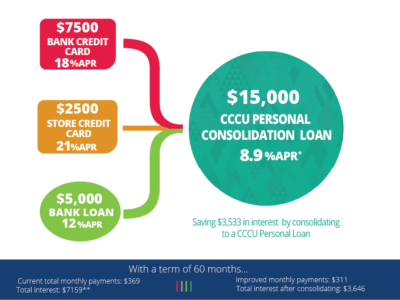

For example, say you have $15,000 in debt spread out like the following:

*Keep in mind most people may only pay the minimum payment due on a credit card or line of credit, thereby extending your payments by years and paying even more interest.

**Payment example: APR based on “A” tier credit borrower. Rate is quoted with AutoPay discount. Loans without AutoPay are 0.50% higher. Monthly payments for a $15,000 Personal Loan at 8.9% APR with a term of 5 years would result in 60 monthly payments of $311

By taking out a loan for $15,000 to pay off these debts completely, you will have the convenience of one monthly payment to repay the new loan. Even better, by consolidating your debt at the lower interest rate, the money that you saved can either go to your savings or towards the loan to pay off the debt even faster! This will result in significant savings over the life of the loan.

The Benefits of Debt Consolidation

So let’s review again, Consolidating your debts can help you take control of your finances:

• Managing debt is easier with a single monthly payment.

• The overall interest rate may be reduced depending on your consolidation option.

• Monthly payment may be lower.

• Fixed payments may result in a faster payoff, especially if the consolidated debts are from credit cards.

• Debt consolidation may improve your credit scores.

Keep in mind though that debt consolidation is not for everyone. Go over a plan to tackle your debt with our team and we’ll help you find a plan that fits your spending habits and lifestyle.

What Debt Consolidation Really Means

It’s inevitable, at some point that we all have more on our plate than we can handle. Sometimes, we’re not financially equipped for the unexpected— a job loss, medical emergency or even broken appliances. It seems like the slightest unexpected event can put too much pressure on your account and using your credit card becomes “Option A” instead of a last resort.

When that happens, you may have found yourself saddled with debt that you’ve accepted as a permanent part of your life. But luckily for you, coming up with creative solutions to chip away at debt is one of our favorite things to do for our members.

Debt Consolidation can move mountains, but it does require commitment on your part. For some, the taste of success can often lead to resorting to old habits, adding on more debt once you start making progress. We help our borrowers here, by paying your outstanding debts directly, eliminating the risk of temptation to use the loan for something other than debt repayment.

Debt consolidation does not eliminate debt. Sometimes, the repayment period may be longer, which could increase the overall cost, or the loan may require collateral such as a home equity-based loan. This is something that will be carefully discussed when looking at which options best suit your individual needs.

What Debt Consolidation Solutions are Available?

Borrowers can choose from a range of debt consolidation options at CCCU:

Personal Loan

Personal Loans are unsecured loans that do not require collateral. Their interest rates tend to be higher than secured loans (Home Equity Lines of Credit or HELOC’s) but are often lower than the rates on your existing debts. As discussed above, they may result in lower interest rates, fewer monthly payments, and improved repayment terms.

Title Loans

If you own your automobile outright, you may be able to use your vehicle title as collateral for a secured loan to repay your debts. Automobile loans normally have much lower interest rates. Even if you don’t currently own your vehicle outright, consider refinancing your existing auto loan and borrow your equity to repay your debts.

Personal Line of Credit (Anytime Moneyline)

A personal line of credit offers a revolving line of credit for those unexpected costs, ask our team if CCCU’s Anytime Moneyline is the right solution to your line of credit needs.

Credit Card Balance Transfer

A credit card balance transfer is a type of transaction in which debt is moved to a lower rate credit card.

Home Equity Line of Credit

A Home Equity Line of Credit (HELOC) uses the equity in a borrower’s home to secure a revolving line of credit. It can be used to cover larger expenses or consolidate debt. With a HELOC, homeowners are using the available equity in their home as collateral for the line of credit. As the borrowed amount is repaid, the available credit is increased until the entire amount is repaid, and the credit line returns to its original amount.

Cash-Out Mortgage Refinance

Homeowners may be able to refinance their mortgage for more than the balance of the original loan. The borrower can then use the cash to pay off existing debt and the cash received will become a part of your mortgage.

How to Choose The Right Debt Consolidation Solution

Choosing the most suitable debt consolidation solution depends on your needs and your personal finances. Whether you are considering applying for a Personal Loan or Line of Credit, HELOC, Title Loan or a balance transfer request to a CCCU Credit Card, you should speak with one of our loan officers today. If you’d like to see if we can help you take steps towards managing your debt, contact our team at [email protected] or call 541-672-9000 today. |